Top Gainer's Move In The Last 5 Mins

-

Highest One Day Odds Right Now

-

Highest 1 Day StockTwits Watchers Growth

-

What Happened With GME?

The Gamestop Saga.

Published October 26, 2021

The story behind GameStop’s stock’s meteoric rise in January of 2021 is nothing short of remarkable. This piece will walk readers through exactly what led to GameStop’s surge in January 2021.

Why is This a Remarkable Story?

Introducing the Hero: Keith Gill

Who is Keith Gill?

Keith Gill, pictured above, also known as Roaring Kitty (Youtube channel and Twitter handle) and as DeepF***ingValue (Reddit handle), is the brilliant man whose posts initiated the Reddit led buying frenzy of GameStop’s stock. GameStop’s January 2021 price surge would turn Keith into a multi-millionaire. Prior to his multi-million dollar investment gains, he was a marketing employee at Massachusetts-based life insurance company, MassMutual. When not at work, he spent his time diligently analyzing companies and stocks to invest in, posting his views on GameStop in Reddit and on YouTube from as early as July, 2020. Most news and press releases have portrayed him as having little formal investment education, portraying him as a “street-smart” individual who outsmarted top hedge fund managers. This, however, is not completely accurate. What they didn’t mention is that Ketih holds the Chartered Financial Analyst designation, the same prestigious advanced investment analysis designation held by billionaire investors Bill Gross and Howard Marks.

His Personal Life

Keith is 35, born on June 8,1986. He lives in a three bedroom home in Wilmington, Massachusetts with his wife Caroline Gill and their 2 year old daughter. In 2009 Keith graduated from Stonehill College with a Bachelor of Science in Business Administration in Accounting. Aside from his intellectual prowess that led to his discovery of the investment opportunity hiding in GameStop’s stock, Keith is also a decorated athlete. His athletic achievements based on his College running bio include:

"2006...All-America for the Skyhawks, first two-sport All-America in Stonehill history (cross country and track), NE-10 Athlete of the Week (9/25/06), Northeast-10 All-Conference First Team...High School... Two-time Boston Globe All-Scholastic team member...Voted Brockton Enterprise Runner of the Year as a senior"

Reddit investors are stereotypically nerdier than your average Joe, have an anti-establishment bent, and are heavy users of classic cultural references in their predominantly humorful posts and comments. Keith doesn’t deviate too far from the stereotype. Aside from the social media names he is often referred to by (DeepF****ngValue and Roaring Kitty), he also carries a third nickname, Mr. Wizard, which was given to him due to his mastery of the Wizard card game. This picture of Keith Gill is a good representation of how he portrays himself on social media:

Note he is sitting on a gaming chair, has Uno cards and a traditional calculator on the table and is wearing a bandana, and wristbands. This is exactly how most would picture a reddit trader.

What Happened to GameStop’s Stock?

The Company

GameStop, is an American video game, consumer electronics, and gaming merchandise retailer. It is the largest video game retailer in the world. The company generates a significant part of its revenue from selling physical video game copies at its brick and mortar retail locations. In 2020 their video game software sales segment made up 38.9% of its total 2020 annual sales as per the 2020 GameStop Annual Report.

Before we go over GameStop’s rise in January 2021, it is important to understand why it’s stock was trading at such low prices prior to it’s wild surge. The reasons behind the original decline in price directly contributed to its January 2021 surge.

The Stock’s Initial Decline

GameStop’s stock declined from a post-2008 peak of $41.25 (dividend adjusted) on November 13, 2013 to it’s all time low of $2.57 on April 3, 2020.

See Stocks Trading Near Their 10 Year Lows Today

See NowWhy Did GameStop’s Stock Decline?

GameStop’s reliance on the sale of physical video game software copies at their brick and mortar locations made its stock an increasingly unpopular investment. This is because it’s business model didn’t align with two important consumer trends:

Shift to online shopping

Federal Reserve Economic Data for the first quarter of 2021 shows Online retail sales have grown to represent 13.6% of all US goods and services sales, up exponentially from the measly 0.8% it represented in the first quarter of 2000.

This is negative for businesses like GameStop as the increase in online shopping has resulted in declining foot traffic to commercial retail locations like GameStop’s stores. This, along with the high costs associated with running these physical locations, has negatively impacted their profit margins.

The digitization of everything

The world now consumes both music and video in their digital form as opposed to the traditional physical formats they were originally created in (CDs, DVDs, etc.). This same shift is occurring to a less pronounced degree in the video gaming industry. The new generation of video gaming consoles included versions of the systems (PS5 Digital Edition, XBOX Series S) that no longer accept video game discs, meaning users of these digital-only consoles can only access new video games by paying for and downloading their games directly on the consoles themselves. This is negative for GameStop as it threatens its important video game software sales business segment.

Along with GameStop’s misalignment with changing consumer trends, it also suffered from a few operational inefficiencies due to failed acquisitions, CEO turnover and poor execution on strategic initiatives. This not only led to negative investor sentiment, but it also affected it’s revenues and profits which led to the decline in its stock price. GameStop’s annual revenues peaked in their fiscal year 2011 at $9.55 Billion and declined to $6.466 Billion by fiscal year 2019. It’s profits peaked in 2010 at $408 Million and declined to losses of $794.8 Million and $464.4 Million for fiscal 2018 and 2019 respectively. The 2020 fiscal year was not mentioned as it was an extraordinary year given the pandemic and is not a good representation of their normal operations.

Introducing the “Anti-Hero” Hedge Fund

The business difficulties and management failures that GameStop was suffering didn’t go unnoticed by profit seeking hedge funds and other institutional investors. Seeing that GameStop’s difficulties wouldn’t be overcome easily, hedge funds like Melvin Capital began placing bets against GameStop’s stock.

Melvin Capital

Melvin Capital is a tech and consumer stock focused hedge fund managed by Gabriel Plotkin. It was the institution with the largest known exposures seeking to profit from GameStop’s stock decline. Prior to GME’s run up, Melvin Capital had amongst the industry’s best returns and was ranked as the 2nd best performing hedge fund managing more than $1 Billion in 2015 by Bloomberg. At the end of 2020, Melvin Capital managed roughly $12.5 Billion. That figure would drop to $8 Billion by the end of January 2021 after it’s portfolio of investments incurred losses of 53% during GameStop’s rise in January, and after receiving a $2.75 Billion emergency cash injection from Citadel LLC and Point72 Asset Management to help Melvin weather the GameStop storm.

Gabriel Plotkin is pictured above.

Investors that want to profit from a stock’s declining price have two main mechanisms through which they can do that.

1. Short-selling

Short-selling is done in the following manner.

How can short-sellers profit?

If the stock has dropped in price after the investor originally borrowed the shares and sold them, they’ll be able to buy the shares back for a lower amount than what they sold them for originally, keeping the difference for themselves as a profit. Here’s an example:

How can short-sellers lose money?

If the price of the stock increases after you originally sell the shares in the market, you’ll have to buy them back at a higher price in order to return them to the brokerage that lent them to you. Here’s an example:

2. Buying put options

What is a put option?

A put option is a contract you can buy on the market that allows you to sell shares of a stock at a predetermined price (the strike price) by a certain date in the future (the expiry date). In order to purchase put options, you must pay the investor selling them to you a premium. This is similar to an insurance premium you would pay an insurance company for covering you in case something bad happens. In this case, you pay the investor selling you the put options, so that if in the future you decide to sell them your shares at the predefined price you agreed on, that investor must purchase them from you, regardless of what the actual market price of the shares is at that moment.

How can put option buyers profit?

Here’s an example: An investor thinks XYZ’s stock price will drop in the next 2 months. The current price of XYZ’s stock is $10. The investor buys put options for 100 shares of XYZ with a strike price of $9 that expire in 2 months. The premium for the options is $1, so the investor pays $100 ($1 X 100) upfront for the 100 puts on XYZ. 2 months go by and the day prior to the options expiring, XYZ is now trading at $5. The investor’s options are now worth at least $4 each. This is because the investor could buy shares of XYZ on the market for $5 now and sell them to the seller of the put options for $9 each. Since options trade on the market, the investor can either sell his options for at least $4 each, or he can buy 100 shares of XYZ for $5 and then sell them to the option seller for $9 each. Either way after taking into account the $100 premium the investor originally paid for the put options, the investor will net a profit of approximately $300 ((100 X $9) - (100 X $5) - (100 X $1)).

How can put option buyers lose money?

Here’s an example: An investor thinks XYZ’s stock price will drop in the next 2 months. The current price of XYZ’s stock is $10. The investor buys put options for 100 shares of XYZ with a strike price of $9 that expire in 2 months. The premium for the options is $1, so the investor pays $100 ($1 X 100) upfront for the 100 puts on XYZ. 2 months go by and on the day the options expire, XYZ is now trading at $20. The investor’s options are now worth approximately $0. This is because the investor would never use his options to sell the shares of XYZ for $9 when they can be sold on the market for $20. Even though options trade on the market, it is unlikely any investor would want to purchase these put options for any significant sum of money as they themselves will have no use for them either. Either way, in this scenario the investor will lose the $100 premium they originally paid for the put options, the investor will net a loss of approximately $100. The maximum loss for a put buyer is the premium they originally paid for the put options.

How Did Melvin Capital Bet Against GameStop?

Melvin Capital employed both put option purchasing and short selling to bet against GameStop. The fund began betting against GameStop in 2016, and by September 30th, 2020 they had $55 Million worth of put options on GameStop and a sizable short position. The short position was likely really large given that Melvin Capital eventually lost more than $6 Billion in January 2021.

Certain investment transactions must be reported by hedge funds through filings with the SEC. Through these filings Melvin Capital made it public that it first bought put options on GameStop in 2016. In the filing on May 16, 2016 Melvin Capital revealed it had put option contracts for 300,000 shares of GameStop that had a market value of approximately $9.5 Million as of the reporting period ended on March 31, 2016. From 2016 to 2020 Gabriel Plotkin continued to add to his fund’s GameStop put positions. In a November 16, 2020 SEC filing Melvin Capital revealed it had increased its exposure to 5,400,000 shares worth of put contracts on GameStop, which had a market value of approximately $55 Million as of the reporting period ended on September 30, 2020.

Based on Gabe Plotkin’s own account during the February 18, 2021 congressional hearings (that took place to determine what had caused the massive volatility in GME during January 2021), his fund had been short selling GameStop from as early as 2014. Unlike put option positions, hedge funds are not required to disclose their short sales on stocks. This makes it impossible to know exactly how many shares of GameStop Melvin Capital had shorted.

Although Melvin’s short position wasn’t made public, it has to have been significantly large given the fund incurred losses above $6 Billion for the month of January, 2021. It is likely that most of their losses came from their short selling. This is because the put options they owned on GameStop as of the end of September 2020 could have resulted in a maximum loss of $55 Million from the end of September, 2020 to the end of January, 2021.

Introducing the “Hero” Hedge Funds

As GameStop’s share price declined, in 2019 some hedge funds and individual investors began to see an opportunity in GME’s low stock price.

Hestia Capital

On Feb 12, 2019, Hestia Capital, a hedge fund that had been invested in GameStop since 2012, wrote a letter to GameStop’s Board of Directors outlining how the management team could improve GameStop’s situation and thereby increase it’s stock price. At the previous day’s close on February 11, 2019, GameStop was trading at $11.30. Hestia thought it was a much lower stock price than was warranted given GameStop’s situation.

In its letter, Hestia had 3 requests for the GameStop Board and management team. They hoped these actions would improve GameStop’s business and thereby turn around it’s declining stock price. It also mentioned it’s opinion that the market was overemphasizing the negative impact that digital video games would have on physical video games. Below are their 3 requests along with excerpts from their letter to the Board:

1. Asking for significant share repurchases

"GameStop’s Board has the ability to create substantial shareholder value through significant share repurchases. Based on Company guidance and SEC filings, the Company likely ended Fiscal Year 2018 with at least $1.5B in cash. In its recent press releases, the Company highlighted three uses of its significant cash holdings: debt reduction, stock repurchase, and acquisition."

At this point in time, GameStop’s stock price was so low, that with the cash the company had on hand, at the February 11, 2019 closing price of $11.30, GameStop could have purchased every single one of its shares back using its cash. This is rare in the stock market and normally only occurs when the market is expecting a company to burn through all of its cash and eventually declare bankruptcy. Given this extreme negativity from the market, Hestia saw this as a great opportunity for GameStop to use it’s cash to buy back shares at a cheap price,which would increase the ownership stake of each of the shares remaining after the buybacks. Hestia was asking for GME to buy back $1 Billion worth of it’s shares over the following 4 years.

2. Improving operating efficiency

"We believe the best first response to industry disruption is to quickly address costs, thereby becoming a more efficient competitor. However, during our seven years as investors in GameStop, we have seen limited evidence that the Company has taken serious steps to eliminate inefficiencies, streamline operations, or take other steps to reduce costs"

Hestia believed that curbing the increased costs the company was experiencing was a low hanging fruit the management team could address to help improve the company’s profitability.

3. Urging the management team to use GameStop’s strong brand value to better compete in the gaming industry

“Additionally, GameStop has a strong position in the gaming community due to its knowledge of, and positive relationship with, much of the “hard core” gaming community. An example of your connection is the extensive customer knowledge and loyalty generated from your PowerUp Rewards program.”

In the years leading up to 2019, GameStop had tried to improve its business results through the acquisition of more than 1400+ AT&T Mobility stores. This acquisition did not fit well with GameStop’s brand and those operations were sold to another company in mid-January of 2019. In their letter, Hestia urged the Board to find a new CEO that would leverage GameStop’s positive brand perception held by gamers. This brand value is clearly demonstrated with the more than 55 Million GameStop PowerUp Rewards members the company had as of November 2020. This number was probably lower at the time the letter was written, but was still significant enough to demonstrate the potential hidden within GameStop’s business.

"It is our belief that physical games have a far more enduring future than the market appreciates because physical media creates value in the industry by allowing for price discrimination. Effective price discrimination requires an obstacle to getting a lower price. Having to deal in physical media accomplishes this, whereas creating such an obstacle with digital gaming is more difficult. For this reason, we believe the outlook for physical media is weak; but not nearly as dire as many believe."

Scion Asset Management (Dr. Michael J. Burry’s Investment Firm)

As Hestia Capital was putting pressure on GameStop’s Board to improve the business, another prominent investment firm saw an opportunity in GameStop’s stock. On February 14, 2019 Scion Asset Management’s 13F form revealed that as of December 31, 2018, it had taken a position in GameStop by purchasing 536,862 shares valued at $6.775 Million.

Scion Asset Management, LLC is a private investment firm managing $638.9 Million in assets based on it’s latest form ADV. The firm was founded and is led by Dr. Michael J. Burry, the famous investor who profited immensely from betting against mortgage backed securities in the 2008 housing crisis. He was portrayed by Christian Bale as the protagonist in the Hollywood hit 'The Big Short'.

Throughout the first 8 months of 2019, GameStop’s stock continued to slide, falling to its 2019 low of $3.15 on August 15, 2019. During this time Dr. Burry continued adding to his fund’s position in GameStop. By August 16th, 2019, Scion Asset Management had increased their stake more than 5-fold to 2,750,000 shares.

Scion’s letter to the board

On August 16th, 2019 Scion Asset Management sent GameStop’s Board a letter of their own. In this letter, Scion primarily focused on pointing out the increased opportunity and value of engaging in an aggressive share buyback program given the low share price. It also brought to the forefront the large amount of short interest the stock had. Below are a few excerpts from the letter:

Share buybacks

"As mentioned in our previous letter to the Board, we have concerns regarding capital management at GameStop. Given recent GameStop common stock prices under $4 per share, we must re-state that GameStop complete the remaining $237,600,000 share repurchase at once and with urgency.

Given the market capitalization of GameStop at $290 million at the close on August 15th, completing the authorization would retire over 80% of GameStop’s outstanding shares. Depending on the timing and quality of execution, such a repurchase would increase earnings per share dramatically - far more than any other possible action on a per share basis.

The numbers are striking and demand action. We estimate that GameStop now has in excess of $480 million of cash, more than enough to complete the share repurchase authorization and still invest in the business and pay down debt."

Following Hestia Capital’s letter to the Board in February of 2019, GameStop’s Board of directors had approved a $300 Million share buyback program. As part of that program, GameStop had bought back 12 Million shares for approximately $62 Million as of July 15, 2019. In Dr.Burry’s August, 2019 letter, he urged the Board to execute the rest of the $300 Million buy back program, by using the $237.6 Million that remained, to purchase more shares at the low prices they were trading for then.

Short interest

"Notably, as of July 31st, 2019, Bloomberg reports short interest in GameStop stock at 57,226,706 shares – this is about 63% of the 90,268,940 outstanding GameStop shares at last report.

We submit that when share prices are at or near all-time lows and more than 60% of the shares are shorted despite cash levels much higher than the current market capitalization, lack of faith in management’s capital allocation is the default conclusion."

Short interest is the total amount of shares that are currently part of an open short sale position. As mentioned earlier, short-selling is a mechanism for betting against a stock and profiting from it’s decline.

In his letter to the GameStop Board, Dr. Burry points out that as of July 31st, 2019, 57,226,706 shares were part of an open short sale position, making up around 63% of the total shares outstanding for GameStop. This means that as at July 31, 2019 there were 57,226,706 shares that were sold short to bet against GameStop, and which were yet to be bought back and returned.

Short interest is an indicator of the market’s sentiment towards a stock. A high short interest as a percentage of a company’s total shares outstanding is an indicator that a relatively large number of market participants (investors/traders) believe the stock is overpriced. In his letter, Dr. Burry points to the short interest as a way of emphasizing to GameStop’s Board of Directors, how poorly they were managing the company. During GameStop’s crazy January, 2021 rally, however, the stock’s short interest ended up playing a very crucial role. This will be covered later on.

Why Did Hestia Capital and Dr. Burry Bet on GameStop?

Both believed that the stock market was overly pessimistic on GameStop’s future business prospects. They believed this excess pessimism had caused the stock price to drop so low that GameStop had become an attractive investment. They also believed that with a few management led initiatives the company could have a brighter future which would lead the stock price to rise.

Keith Gill Bets on GameStop

As the funds mentioned above were taking notice of GameStop and betting on a brighter future for the company’s shares, some individual investors were also sensing an opportunity. In particular Keith Gill (a.k.a RoaringKitty and DeepF***ingValue). He made his first Reddit post revealing his bets on GameStop’s stock on September 8th, 2019.

Timeline of Events

The sections above were meant to give readers an understanding of who the important players in the GameStop story were, as well as what the main reasons some investors had for betting aggressively on the stock’s demise, and the reasons others had for betting aggressively that the stock would rise. Going forward we’ll outline the important events leading up to GameStop’s January 2021 rise. The events will include a description, their impact on investors, and the price of GameStop’s stock when the events took place. The goal is to make readers feel as if they’re reliving the craziness as it’s occurring.

Event #1

Keith Gill Posts His First GameStop Reddit Post, Under the Reddit Handle DeepF***ingValue.

Current Event (Sep. 8, 2019)

Final Event (Jan. 28, 2021)

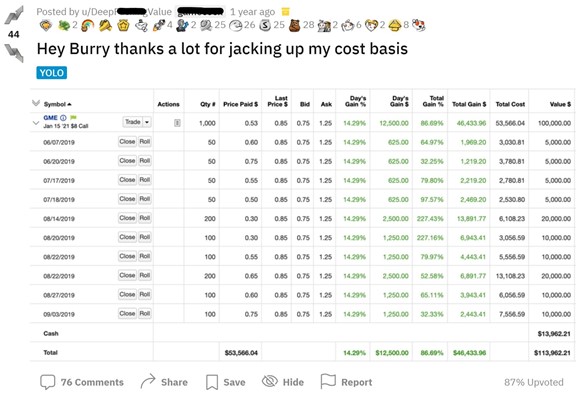

On Sunday, September 8th, 2019, Keith Gill made his first reddit post related to his GameStop investment. The post is a screenshot of his E-Trade investment account, showing his GameStop investments as well as the cash held in his investment account. Here is the post below.

The post reveals a total of 100,000 shares worth of call options with a strike price of $8, expiring on January 15, 2021 that Keith purchased for $53,566.04 as well as $13,962.21 of cash in his account. At the time of his post, Keith’s investment was worth $100,000, up $46,433.96 from when he originally purchased the call options.

Keith’s investments would be considered a very aggressive bet on a stock, especially considering Keith GIll was a working class man when he made this investment. Call options are very risky, as they can expire worthless if the stock is trading below the strike price at the time of the option’s expiry. This post got 44 upvotes, and 76 comments due to the aggressive, high risk nature of the investment. It also sparked some “hate” as some reddit users believed his options were sure to lose him money due to some of the negative narratives about GameStop’s viability as a business.

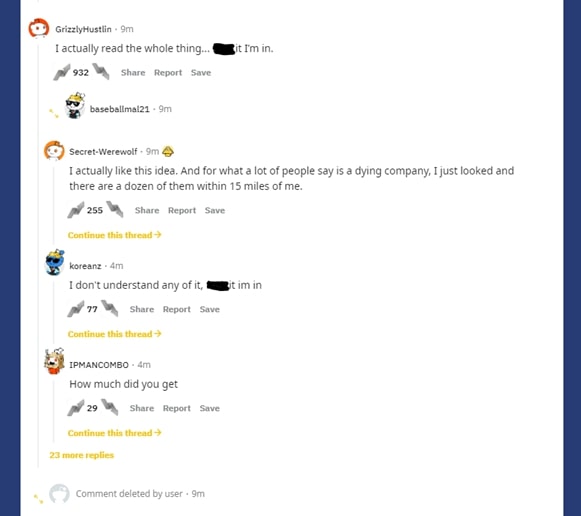

Here are some of the comments he received on this post.

This would be the first of his many “YOLO Update” posts, where he would screenshot his investment account to let other reddit users know how his GameStop investments were doing.

Call options are the opposite of put options which were discussed earlier. A call option is a contract you can buy on the market that allows you to buy shares of a stock at a predetermined price (the strike price) by a certain date in the future (the expiry date).

In order to purchase call options, you must pay the investor selling them to you a premium. Again, this is similar to an insurance premium you would pay an insurance company. In this case you pay the investor selling you the call options, so that if in the future you decide to buy shares from them at the predefined price you agreed on, that investor must sell them to you at that strike price, regardless of what the actual market price of the shares is at that moment.

How can call option buyers profit?

Here’s an example: An investor thinks XYZ’s stock price will go up in the next 2 months. The current price of XYZ’s stock is $10. The investor buys call options for 100 shares of XYZ with a strike price of $11 that expire in 2 months. The premium for the options is $1, so the investor pays $100 ($1 X 100) upfront for the 100 calls on XYZ. 2 months go by and the day prior to the options expiring, XYZ is now trading at $15. The investor’s options are now worth at least $4 each. This is because the investor could buy shares of XYZ for $11 from the investor that sold them the call options and then immediately sell the shares on the market for $15 each. Since options trade on the market, the investor can either sell his options for at least $4 each, or he can buy 100 shares of XYZ for $11 and then sell them on the market for $15 each. Either way after taking into account the $100 premium the investor originally paid for the call options, the investor will net a profit of approximately $300 ((100 X $15) - (100 X $11) - (100 X $1)).

How can call option buyers lose money?

Here’s an example: An investor thinks XYZ’s stock price will go up in the next 2 months. The current price of XYZ’s stock is $10. The investor buys call options for 100 shares of XYZ with a strike price of $11 that expire in 2 months. The premium for the options is $1, so the investor pays $100 ($1 X 100) upfront for the 100 calls on XYZ. 2 months go by and on the day the options expire, XYZ is now trading at $5. The investor’s options are now worth approximately $0, since the investor would never use his option to buy the shares of XYZ for $11 when they can be bought on the market for $5. Even though options trade on the market, it is unlikely any investor would want to purchase these call options for any significant sum of money as they themselves will have no use for them either, since they can buy shares in the market at $5, which is much better than the $11 they could buy the shares for using the options. Either way, in this scenario the investor will lose the $100 premium they originally paid for the call options, the investor will net a loss of approximately $100. The maximum loss for a call buyer is the premium they originally paid for the call options.

Event #2

GameStop Announces it Has Repurchased 36% of its Shares Outstanding During the First 3 Quarters of 2019. Link To Announcement.

Current Event (Dec. 10, 2019)

Prevous Events

Final Event (Jan. 28, 2021)

After receiving pressure from both Hestia Capital and Dr. Burry’s Scion Asset Management, GameStop repurchased 34.6 Million shares for a total of $178.6 million during the first 3 quarters of 2019. This was significant as it reduced GameStop’s share count to 67.8 million shares outstanding, increasing the proportional ownership of each share still outstanding by approximately 56%.

The large amount of share repurchases was also meaningful due to the high short interest the stock had accumulated at this time. Reducing the total shares outstanding would make it harder for short sellers to close out their positions when they no longer wanted to bet against GameStop.

Short sellers at some point were going to have to close out their bets against GameStop. To do this, they must repurchase the shares they’ve sold short in the market and give them back to the brokerage that lent them the shares. Since the company was buying back its own shares and retiring the shares, the total shares available for short sellers to buy back and close their positions was dwindling.

In GameStop’s case specifically, short sellers had short sold a high amount of shares relative to those readily traded in the market. Even before the share buybacks, for all short sellers to close out their bets against GME at once, they would have had to get their hands on 63% of all outstanding GameStop shares, based on the short interest reported by Bloomberg on July 31st, 2019.

It’s important to note some shares were held by insiders (The GameStop management team and other employees) as well as by some long-term investing institutions, neither of which regularly trade their shares. The amount of shares outstanding for GameStop that are readily available in the market is called GameStop’s free float. Free float excludes the shares held by insiders and long term investing institutions.

GameStop’s free float was shrinking due to the share buybacks just as the short interest on it’s stock was increasing. Based on the short interest report that NYSE releases regularly, GameStop’s short interest as a percentage of it’s free float was 111.29% on December 13th, 2019. This meant that if all short sellers wanted to close out their positions on December 13th, 2019, they would have had to purchase every single share that was readily available and then somehow get their hands on shares held by long-term investing institutions or company insiders.

The amount of unrealized losses that short sellers can experience is theoretically unlimited. This means that if GameStop’s business outlook improved and the stock started to rise rapidly, which now we know it did, short sellers at some point would begin to accumulate enough unrealized losses that they would be forced to buy back the shares they short sold in order to stop the losses. As the stock is rising and short sellers are starting to buy back the shares they sold short, having few shares available in the market makes it harder for short sellers to find enough shares to purchase. In GameStop’s case specifically, having an 111.29% short interest as a percentage of it’s free float, meant that as the price went up, short sellers would be racing each other to buy the limited supply of shares. This would cause them to compete with each other for the shares by offering higher and higher prices in the market just to buy back the shares they needed. This creates a vicious cycle of increasing prices and rapidly growing losses for short sellers. This nightmare scenario for short sellers is known as a 'Short Squeeze'. This phenomenon was a large reason behind GameStop’s rise in January 2021.

Event #3

Keith Gill (DeepF***ingValue) Posts an Update Screenshot on Reddit of Losses He’s Incurred on His GME Investments. Link To Post.

Current Event (Feb. 29, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

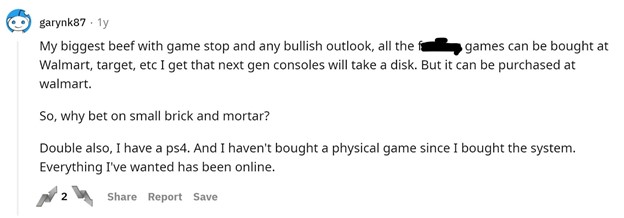

On Saturday, February, 29, 2020 Keith Gill posted one of his regular updates showing the reddit community how his GameStop investments were performing. By this point fears of what the novel COVID-19 virus could do to the global economy were building.This had caused the SP 500 to drop 12.95% from its all time high reached just 10 days earlier on February 19, 2020. Due to poor earnings results in the quarters that had just passed as well the fears of what COVID-19 could do to a brick and mortar business like GameStop’s, GME was trading at just $3.60 compared to the $6.51 it had traded at on December 10, 2019. Here’s Keith’s post.

What’s shown in the post?

In the post, Keith reveals he had increased his position to 260,000 shares worth of call options costing him a total of $86,677.39 up from the 100,000 in his original post (posted on Sept 8th, 2019) that he’d purchased for $53,566.04. Due to the decline in GameStop’s price, the screenshot shows he is now in the red, and his investment is down $42,377.39 or 48.89%.

Why is it important?

This update was significant because it showed Keith’s conviction in GameStop’s stock as he had continued to increase his bets on the stock even as the stock fell. It also shows readers that although his investment was ultimately incredibly lucrative, it wasn’t a smooth ride, at this point in time he was down $42,377.39.

Event #4

Dr. Burry’s Scion Asset Management Increases its Stake in GameStop to 3.4 Million Shares. Link To Filing.

Current Event (Apr. 2, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

Dr.Burry had continued to acquire shares in GameStop and had accumulated 3.4 Million shares in the company by April 2, 2020, making Scion Asset Management a 5.3% owner of Gamestop at the point. Acquiring more than 5% of the company’s shares required him to file a Schedule 13D. This filing was significant as it showed that a well respected investor like Dr. Burry continued to believe in GameStop’s future and had increased his stake by more than 6-fold from the 536,862 shares Scion Asset Management originally purchased in late 2018.

Event #5

GameStop Hits its All-Time Low.

Current Event (Apr. 3, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On Friday April 3, 2020 GameStop would hit what is to this day the lowest price it’s ever traded at, $2.57. From this point forward the stock began its ascend into the triple digits.

Event #6

Keith Gill (DeepF***ingValue) Posts an Update Screenshot on Reddit of the Large Gains he’s Made on His GME Investments. Link To Post.

Current Event (Apr. 30, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

During the month of April the market began to recover from it’s COVID-19 driven fall it experienced in February and March of 2020. At the close of trading on April 30th, 2020 the SP 500 was up 32.87% from it’s 2020 low that it had reached just a month earlier on March 23, 2020. Along with the market recovering, GME also experienced an explosive recovery from it’s lows and was up 123% from the all-time lows it had reached less than a month earlier on April 3, 2020. This rebound in GameStop’s shares was likely due to both the change in sentiment for stocks by investors in general as well as the positive sentiment generated by Dr. Burry’s 5.3% stake in the company.

The rise in GameStop’s stock’s price favoured Keith’s investments really well as you will see below in his Reddit update post.

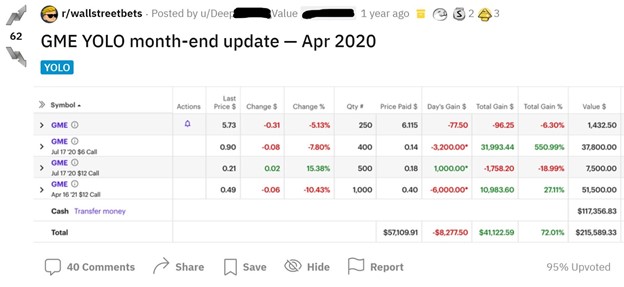

What’s shown in the post?

In this screenshot we can see that Keith had at this point purchased 250 shares of GameStop and likely cashed in on some of the gains from his call options. We can assume this because at this point he held 190,000 shares worth of call options as opposed to the 260,000 he held in his February, 29, 2020 “YOLO update” post, and he now had $117,356.83 in cash in his account. Although he now had fewer call options, they were worth a lot more, with a market value of $98,232.50. Based on the increase in market value of the call options he still held as well as the cash he held, Keith was up $128,728.11 (149%) on his GameStop investments at this point.

Why it’s important?

This update post was significant as it was his first month-end update in 2020 showing significant gains on his investments.

Event #7

Keith Gill (Roaring Kitty) Posts His First YouTube Video on Why He Thinks GameStop is a Good Investment.

Current Event (Jul. 27, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On July 27, 2020 Keith Gill posted his first YouTube video on GameStop and why he thought the shares were deeply undervalued and likely to go up. In the video he walks the viewers through a very deep analysis he performed on GameStop.

This is one of the most thorough stock research videos I have ever come across on YouTube. He analyzes the company as a business, provides external research that backs all of the points he makes, creates a projection of the company’s financial statements, shares with readers the reasons some people are betting against GME and provides solid research refuting those people’s most fundamental points for betting against GameStop. He does this while remaining genuinely humble and open to the fact that he might be missing something.

Throughout the video he says multiple times that he would love for viewers to comment or write to him if they have solid theories as to why GameStop isn’t a good investment at the low price it was trading at then, making it clear he was open to having his mind changed. I believe it is the humility displayed in his YouTube videos as well as his evidence-based convictions about GameStop’s merits as an investment, that eventually made him such a well liked individual in the Reddit community as well as a great protagonist for journalists.

Why did he make the video?

Based on his intro, he likely posted the video out of frustration that the stock was again trading at a very low price. Here’s how he started the video:

"Yo what up everybody, this is going to be the first video of the Kitty corner. And… the market has kind of forced my hand on this one, the first stock that I’m going to talk about is GameStop"

Why did Keith Gill believe GameStop was a good investment?

Keith Gill thought GameStop was a good investment because he saw many of the same opportunities that Hestia Capital and Dr. Burry had pointed out in their letters to the Board. He believed the market was underappreciating the cash GameStop had on hand, the strong brand value it had amongst gamers, and how long physical games would continue to be valued amongst gamers.

More than providing unique perspectives on GameStop, his video is excellent due to the level of research and analysis he presents in order to validate the points above which had already been made by investment institutions like Hestia Capital and Scion Asset Management. Below are a couple of the points he makes along with the evidence he presented in his video that highlight his excellent research skills:

Point 1 - The stock market is over-estimating the speed at which digital games will replace physical copies.

To make this point he shows a Statista report that says that as of 2018 only 17% of video games are being purchased in physical form. He makes the point that statistics like this one could have been misleading investors into thinking GameStop was in more trouble than it actually was. This is because digital purchases, which made up the other 83% in the report, were potentially skewed by in game and in app purchases, which might have been counted as digital video game purchases, instead of being put in their own category. To prove this point he cites the following excerpt from an article called 'Rumors of the Death of Physical Video Games Have Been Greatly Exaggerated' which cites statistics from a report by the UK’s Entertainment Retailers Association:

“The UK’s Entertainment Retailers Association reported that 80% of game sales were digital in 2018 – although that number included content like costumes and in-game currency, not just the games themselves. Sales of EA Sports’ FIFA still generated 75% of core sales from discs in 2018, according to the UK report. Overall industry sales need to consider the rise of apps too. A 60% drop in physical sales from 2009 to 2017 seems dramatic but consider the revenue sources. That’s not only Xbox and PlayStation involved, skewing the numbers, making the total loss difficult to pin down. A 2018 report from Nielsen states a majority of game consumers prefer physical.

To further prove his point, at the 10:50 mark of his video, he references a few YouTube videos from popular video gaming influencers. In the videos, the influencers are discussing which consoles they recommend people buy, between the digital only versions and the versions that accept discs for the new generation of the Playstation and Xbox consoles. In these videos the influencers are almost always opting for the physical disc versions of the consoles and even within the comments of the videos, YouTube users mention their preference for owning physical versions of the video games they buy.

Point 2 - GameStop has a really strong brand that is being under-appreciated by the market.

Keith pulls up a wikipedia page in his video that shows a list of the top magazines for each country in the world ranked by number of copies distributed. Surprisingly, GameStop’s Game Informer magazine is the 5th most circulated magazine in the United States, more than Time Magazine.

Aside from his thorough qualitative research, he does a very good job at quantifying what his different assumptions would mean for GameStops revenues, profits and assets. Based on this financial analysis he determined $8-$12 to be a fair price for GameStop’s stock.

What about the short squeeze?

Interestingly enough, in this initial video, Keith only mentions the high short interest in passing. At this point in time, he was more focused on the opportunity in GameStop’s stock based on how overly pessimistic the market was on GameStop’s future outlook. This would change in his later videos, where the potential for a short squeeze became a more prominent theme.

Why was this video important?

His ‘average Joe’ demeanor and limited use of finance jargon made the GameStop investment thesis very digestible for retail investors. This would later allow the GameStop investment thesis to become easily spreadable on online forums like Reddit as a lot of novice and experienced investors alike could easily understand the opportunities and risks of investing in GameStop.

Event #8

Ryan Cohen Reveals a 9% Stake in GameStop.

Current Event (Sep. 8, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On August 18, 2020 Ryan Cohen filed a 13D Schedule with the SEC that revealed he’d purchased 5.8 Million shares in GameStop for $33.97 Million. This amounted to 9% of GameStop’s shares outstanding. He would increase his stake to 6.21 Million shares in Gamestop 10 days later. This was revealed in a 13D Amendment he filed on August 28th, 2020 which showed his total stake had cost him $36.69 Million and made him a 9.6% owner of GameStop.

Who is Ryan Cohen?

Ryan Cohen is the 35 year old co-founder and former CEO of Chewy, an online retailer of pet food and other pet-related products. Ryan founded Chewy when he was 25. His successful management of Chewy allowed him to sell the company to PetsMart for $3.35 Billion in 2017, at the time the largest e-commerce acquisition ever.

Why was Ryan Cohen’s 9.6% stake in GameStop important?

GameStop’s management team had been struggling with growing its e-commerce business and with leveraging its strong brand value to improve its business. Ryan Cohen’s past success as the visionary and founder of one of the most successful e-commerce businesses ever, made him someone who could likely use his ownership in GameStop to influence the management team and help solve GameStop’s troubles. As we’ll cover later, Ryan Cohen would become one of the protagonists in GameStop’s January 2021 rise.

Event #9

The GameStop Short Squeeze Story Takes Hold on Reddit. Link To Post.

Current Event (Sep. 22, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On Tuesday, September 8th, 2020 redditor Jeffamazon posted what would become one of the most influential posts on Reddit’s WallStreetBets subreddit.

What was the post about?

In his post he explained why he was convinced GameStop was primed for one of the biggest short squeezes in the stock market’s history. He thoroughly showed the Reddit community why GameStop was susceptible to a short squeeze and the possible alternatives of good news in the near future that could trigger the squeeze. He shows that including the shares owned by Ryan Cohen at that point (shares Ryan was likely holding for long-term investing), the amount of shares short, made up over 112% of GameStop’s readily tradable shares. As discussed above, a ratio this high would cause a lot of problems for short sellers if the price of GameStop began to rise.

In the post he explains another concept which he thought would also add fuel to the short squeeze. He explains that if investors bought far out of the money call options, they would cause the market makers that sold them the call options to have to buy shares of Gamestop. This would add more demand for GameStop shares. The reason this happens is because the market makers (institutions responsible for making sure that markets have liquidity) are normally the ones buying and selling call options when an investor/trader is buying or selling calls.

A market maker’s goal is to make money from the difference in what they buy the call from one investor versus what they sell it for to another investor. They are not betting on or against the companies they buy and sell options on, they are trying to make a spread regardless of what the stock does. In order to mitigate the risk of losing money on the calls they sell, they buy a few shares of the companies they sell calls on, and if the price of the stock they’ve sold calls on increases, they buy more shares to gain more protection. The Redditor essentially told the readers that if everyone started buying calls on GameStop, they would force the market makers to buy shares as protection against the calls they were selling to them. This would further reduce the shares available for short sellers to close out their positions and it would help push the stock price higher.

In his own words:

"It looks like this: RH(RobinHood) Call Option buying -> MM(Market Maker) Delta hedging/share purchase -> short squeezing -> Greater retail/RHers price action chasing/call option buying -> MM Delta hedging/share purchase -> short squeezing -> Institutional and new channels flip the script -> GME to $400+ -> cash out."

Why was this post important?

This post garnered a lot of attention on WallStreetBets as it gained more than 8,000 upvotes and more than 1,300 comments. This was likely the post that truly made the WSB(WallStreetBets) community aware of the possibility of a short squeeze with GameStop’s stock.

The post also showed traders how banding together and overwhelming the market with call option buying could be one of the triggers of the short squeeze and how they could profit together from the resulting jump in GameStop’s price. It is clear from the most upvoted comments on the post, that this post likely spurred a lot of retail traders to begin buying both GameStop shares and call options.

See The Stocks Gaining The Most Popularity On StockTwits

See NowBelow are some of the comments.

The comments mentioning “DD” refer to “Due Diligence”, a category of posts on WallStreetBets where redditors share their long form analysis on stocks they’ve performed research on.

Event #10

Keith Gill’s (DeepF***ingValue) Investments Cross the $1 Million Mark. Link To Post.

Current Event (Oct. 8, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

Below is Keith’s update post from September 22, 2020.

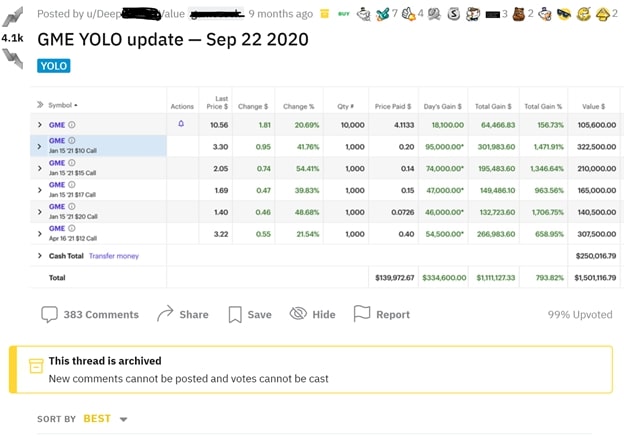

What’s shown in the post?

In this screenshot we can see Keith is now up $1.36 Million on his GameStop investments. At this point his account value has increased to $1,501,116.79 making it his first update post where his GameStop investments are worth more than $1 Million. His investment in GameStop was 10,000 shares and 500,000 shares worth of call options at the time of this post.

Why was he up so much?

By this point, Ryan Cohen’s and Dr. Burry’s bets on GameStop were starting to get noticed by retail investors. Posts on Reddit like the one by Jeffamazon as well as research reports written on SeekingAlpha (an online community where users can share their research on investments) were starting to create a buzz for GameStop in the retail investing community. This changing sentiment had driven the price up 37.14% in the 14 days that had gone by since Jeffamazon’s post.

Why is this important?

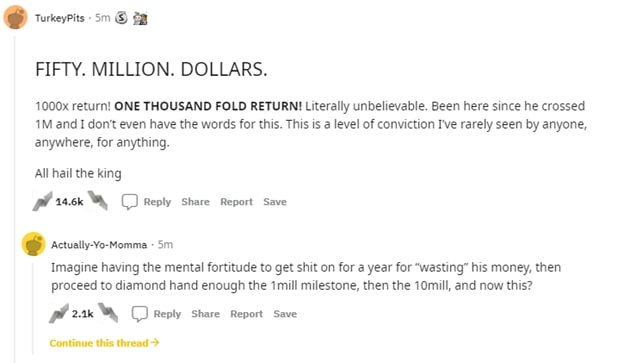

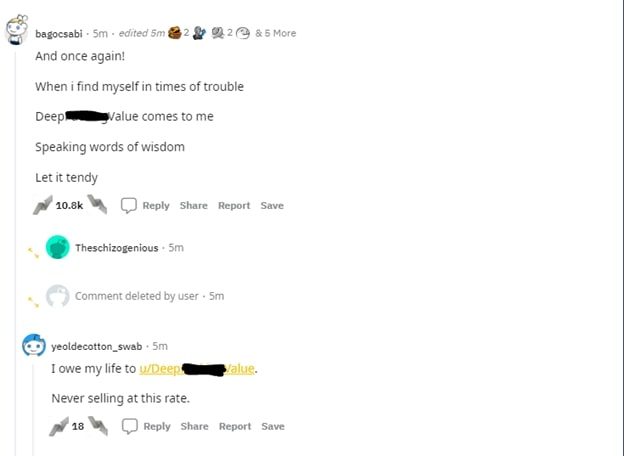

This update post was significant as it was Keith’s first post showing that he made more than $1 Million with his GameStop investments. His original post revealing his investment had been received with a lot of doubt and people telling him he was destined to lose his money. The comments on this post looked a lot different. By this point the reddit community was aware of the possibility of a short squeeze, and they were starting to view DeepF***ingValue as a hero for having held onto his investments even as they had dropped by more than 40% in February of 2020.

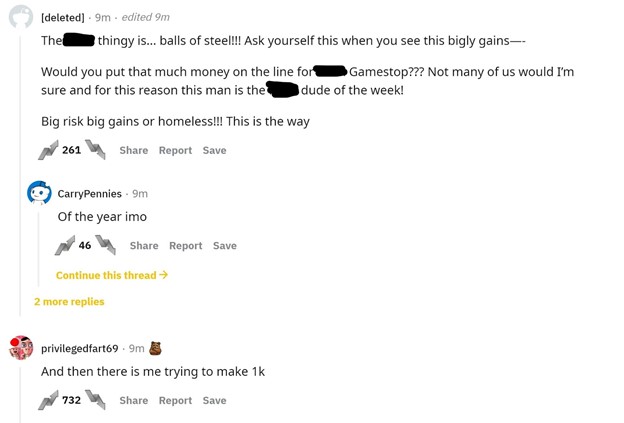

Below are some of the comments he received on this post.

Event #11

GameStop Partners With Microsoft. Link To Announcment.

Current Event (Nov. 16, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

What was involved in GameStop’s partnership with Microsoft?

On October 8, 2020 GameStop publicly announced that it had reached a multi year partnership with Microsoft. The Partnership entailed two main benefits for GameStop.

Why was the Microsoft partnership important?

This partnership was viewed as important by investors as it was one of the first signs that GameStop’s management team was beginning to make changes to modernize GameStop. The market reacted very positively to this news, driving the price up 44.12% from the previous day’s close. The move was on volume of more than 77 million shares, the highest volume ever for GameStop’s shares up to that point.

Event #12

Ryan Cohen Blasts the GameStop Board in a Letter to the Board. Link To Letter. Link to WallStreetBets Post Discussing Letter.

Current Event (Nov. 29, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

What was said in Ryan Cohen’s letter to GameStop’s Board?

On November 16, 2020, Ryan Cohen, now owning 9.98% of GameStop’s shares, wrote a very public letter criticizing the GameStop Board of Directors. In the letter he calls out the Board for being unaccountable and unadaptable as GameStop failed to capture the growth in the gaming industry by remaining a simple brick and mortar retailer. He restates many of the same points previously mentioned by Dr. Burry, Hestia Capital and Keith Gill. He advises the Board to close unprofitable stores and to leverage their high brand value amongst gamers to create an offering within video game streaming and digital gaming which are rapidly growing markets. He makes it clear that the Board had failed to guide GameStop in the right direction.

"Through our private conversations, we have explained to Mr. Sherman and the Board that GameStop has the ability to pivot toward becoming a technology-driven business that excels in the gaming and digital experience worlds. But this pivot requires the type of strategic vision that has not yet taken hold in the c-suite or Boardroom of the company."

"In this spirit, we urge you to quickly provide stockholders with a credible and publicly-available roadmap for cost containment, prioritizing profitable retail locations and geographic markets, and building the e-commerce ecosystem gamers deserve."

He closes the letter off with a threat, at least that’s how the investment community saw it.

"Please be advised that RC Ventures is not interested in receiving a lone seat on GameStop’s ten-member Board. It is not enticing to become an isolated stockholder advocate on a Board that has overlooked years of digital revenue opportunities and presided over massive value destruction without assuming full accountability. We want GameStop’s leaders to do their jobs and implement a strategy for bringing the Company into the 21st century."

Investors perceived the last paragraph to be a threat to the Board, as he seems to imply that simply giving him a seat on the Board won’t be enough for him to go away. Investors perceived this letter to imply that either the Board starts to act on GameStop’s opportunities, or Cohen will use his large ownership and influence to not only get himself on the Board but to get rid of the current Board and vote on new members that will push the management team in the right direction.

Why was this letter important?

The threatening undertone of the letter and the clear strategic initiatives that Ryan Cohen outlines were received very positively by investors. They saw this letter as a sign that there was finally going to be someone that was going to be able to help GameStop adapt to the new world of gaming. Given his success with Chewy, this was a man the retail investment community trusted. This type of activity from a prominent entrepreneur also helped increase the probabilities that more positive things could happen for GameStop. Any of which could propel the short squeeze the Reddit community was betting on. By November 30th, just 2 weeks after this letter, the stock had risen 37.31% to $16.56.

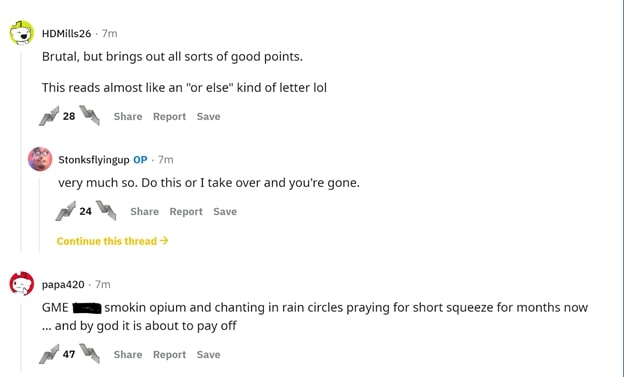

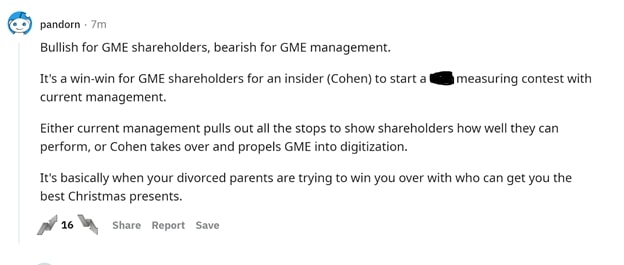

Here are some comments from a post discussing the letter on the day it was released.

Event #13

Reddit Finds Out Melvin Capital is Short GameStop Link To Post.

Current Event (Aug. 18, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On November 29, 2020 Reddit user ronoron {https://www.reddit.com/user/ronoron/} made a post on the WallStreetBets subreddit showing users that Melvin Capital had a large bet against GameStop.

What was the post about?

The reddit user had gone through their regulatory reports and found that they had 5.4 Million shares worth of puts at this point. The user speculated that Melvin Capital likely also had a really large short position on GameStop; he couldn’t confirm that, as short selling by institutions does not have to be reported. He made this educated assumption based on the aggressive nature of the puts, Melvin Capital’s tendency to make aggressive bets, and the fact that the short interest remained so high even as GME had risen more than 5-fold from it's all time lows in April. He reasoned only a really large hedge fund like Melvin Capital would be betting this aggressively against GameStop and be able to continue holding the position even as the losses continued to mount.

Why was this post important?

Generally speaking, WallStreetBets members have an anti-establishment bent that can be seen across their posts and comments. Short-sellers are seen as evil in the eyes of the WallStreetBets community. They are seen as high class elites, attempting to profit from businesses' demise. Given this sentiment, Melvin Capital became a target of hate for the WallStreetBets community.

Event #14

Keith Gill’s (DeepF***ingValue) Portfolio Crosses the $3 Million Mark. Link To Post.

Current Event (Nov. 30, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

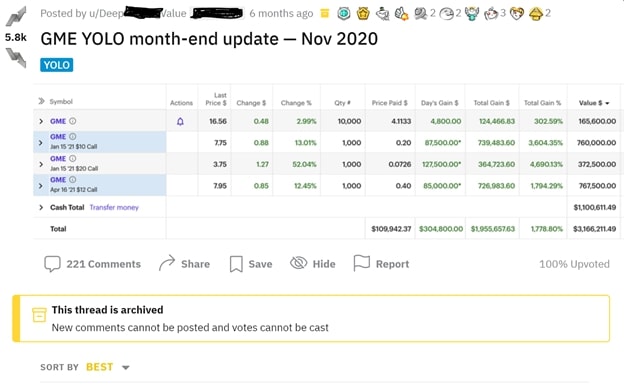

Below is a screenshot of Keith’s update post from November 30th, 2020:

What’s shown in the post?

In this screenshot we can see Keith’s portfolio is now worth more than $3 Million. At this point he has sold and realized the gains on 200,000 shares worth of call options, and his investment in GameStop is now 10,000 shares and 300,000 shares worth of call options.

Why was he up so much?

Ryan Cohen’s threatening letter to the Board of Directors was received very positively by the market as discussed earlier. This caused the price of GameStop to rise more than 37% in the two week period between Cohen’s letter and DeepF***ingValue’s YOLO Update post on November 30, 2020. The rapid rise in price caused Keith’s call options to appreciate significantly, leading to most of the gains seen in the screenshot above.

Why is this important?

Keith’s sequence of consecutive update posts showing higher and higher portfolio values, continued to spur the buzz that was already building about GameStop on retail investing social media platforms like WallStreetBets. Users were inspired by Keith’s ability to continue to hold his investments in GameStop even after turning his total investment of less than $150,000 into more than $3 Million. These types of posts, of a working man making millions by betting on GameStop, helped add fuel to the rising prices GameStop’s stock was experiencing, as it inspired more and more retail investors to invest in GameStop.

Event #15

Ryan Cohen Increases His Stake in GameStop to 12.9% of the Company. Link To Filing.

Current Event (Dec. 17, 2020)

Prevous Events

Final Event (Jan. 28, 2021)

On December 17, 2020 Ryan Cohen filed a 13D Schedule with the SEC that revealed he’d increased his stake in GameStop to 9,001,000 shares which he paid $75.90 Million for. This amounted to 12.9% of GameStop’s shares outstanding.

Why was Ryan Cohen increasing his stake in GameStop to 12.9% important?

Ryan Cohen’s confidence in GameStop, demonstrated by his continued purchasing of its shares even as the price was rising, was received very well by the market. 6 days later, on the close of December 23, 2020 the price of GameStop’s shares had already risen another 38.7% to $20.57, the first time the stock closed above $20 since October 10, 2017.

Event #16

Ryan Cohen Gets Appointed to the GameStop Board of Directors. Link To Announcement.

Current Event (Jan. 11, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

On January 11, 2021 GameStop announced that it had reached an agreement with Ryan Cohen to give him as well as 2 of his previous executive colleagues from Chewy seats on the Board.

Why was Ryan Cohen’s appointment to the Board important?

Ryan Cohen’s appointment to the Board along with Alan Attal the ex-Chief Marketing Officer of Chewy and Jim Grube the ex-Chief Financial Officer of Chewy meant that Ryan Cohen would now be able to directly influence the GameStop management team. The 3 new Board members' success with Chewy gave GameStop investors even more hope that the company would enter a new growth phase.

Furthermore, his appointment to the Board further signaled to the market that Ryan was going to be sticking with his GameStop investment for the long run. This is the kind of good news that retail traders on Reddit’s WallStreetBets were waiting for to help initiate the short squeeze. At the close of market on January 14th, 2021, just 3 days after this announcement, GameStop’s shares had almost doubled and traded at $39.91.

Event #17

Andrew Left, a Prominent Short Seller, Shorts GameStop and Shares a Video of Why He Thinks the Stock is Going Back to $20.

Current Event (Jan. 21, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

Who is Andrew Left?

Andrew Left is a prominent investor and founder of a popular investment newsletter Citron Research. His goal is to find companies that are either committing fraud or are overvalued. Once he identifies these companies, he publishes reports that advise readers to short sell the stocks of these companies, with him also often shorting the stocks he writes about.

One of his most successful shorts was on Valeant Pharmaceuticals, now Bausch Health, he wrote several reports claiming they were overstating their revenues and illegally guiding their customers to purchase more expensive drugs than necessary. His initial report was released on September 28, 2015. The reports led to an investigation on Valeant Pharmaceuticals by the SEC. At the time Valeant was Canada’s largest company by market capitalization. The scandal led to the company’s stock declining as much as 95.77% less than 2 years after his reports were released.

How is Andrew Left involved with GameStop?

On January 19th, Andrew Left posted from his Citron Research Twitter account that he would be releasing 5 reasons why people buying the stock were “suckers” and why the stock would fall back to $20.

Below is the tweet.

The tweet was taken as condescending by retail investors and received a lot of hate in the comments section. Here are the top comments on this tweet.

On January 20th, Andrew decides to postpone his livestream to the following day as he claims not wanting to interrupt Biden’s presidential inauguration ceremony.

On January 21st Andrew Left started his livestream and ended up suffering “technical” issues and was unable to host the livestream. He blamed the issues on angry reddit investors attempting to hack his Twitter. Here’s his tweet when this happened.

Later that night Andrew Left uploaded a video to YouTube explaining his 5 reasons GameStop was going back to $20 and why it was overvalued at the current price. In the video he also reveals that he himself is short GameStop. The reasons he provides are more or less the same weaknesses in GameStop’s business that most investors were already aware of. He carries through the video with an arrogant demeanor and states that even if the stock keeps rising, he’ll simply continue to short sell it at higher prices.

Why is this important?

As mentioned earlier, short sellers are hated in the WallStreetBets community. Andrew Left, being a short seller and also publicly bashing the stock that many in the reddit community were invested in, made him public enemy number one. Because of this, Andrew Left’s video was received almost as a challenge by the reddit investing community. Traditionally, the release of his short-selling reports led to the target companies’ stocks significantly declining in the days following the release of his reports. This time, the exact opposite occurred.

Event #18

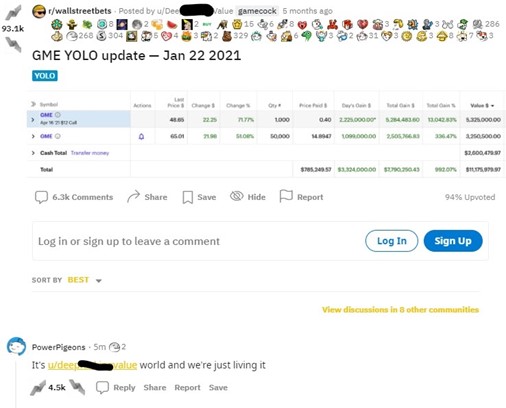

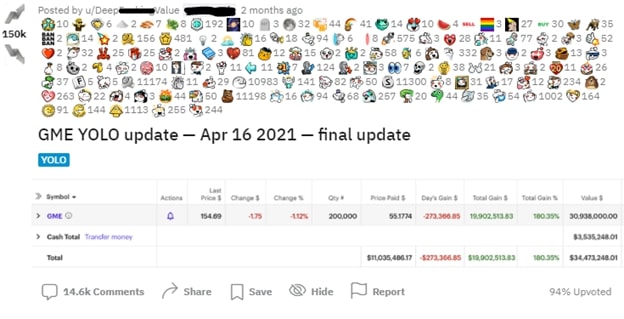

GameStop’s Short Squeeze Begins - Keith Gill’s Portfolio Crosses the $10 Million Mark. Link To Post.

Current Event (Jan. 22, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

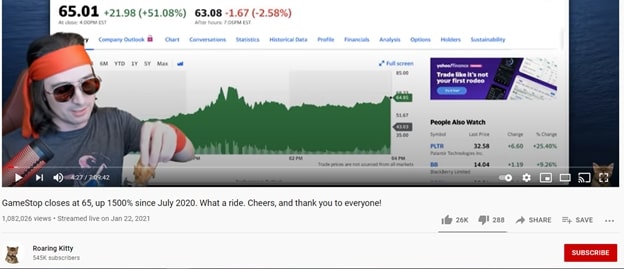

What happened?

On Friday, January 22, 2021, the day following the release of Andrew Left’s GameStop YouTube video, GameStop’s stock moved suddenly from it’s opening price of $42.59 to a high of $76.76 before closing at $65.01. This was it’s highest close ever at that point, up 51.08% from the previous day’s close . It was also the day with the highest volume ever for GameStop’s shares up to that point. January 22, 2021 marked the beginning of the short squeeze for GameStop’s shares. It also marked the beginning of mounting ridicule and investment losses that Andrew Left would sustain.

See The Stocks Moving Up The Most Right Now

See NowWhy do we think this was the start of the short squeeze?

The move happened suddenly during the trading day on the highest volume GameStop has ever experienced. A move of this magnitude occurring without any specific news item coming from the company is a good indication that this was the breaking point when some short sellers could no longer handle the losses and thus began racing to buy the shares back that they needed to close out their short positions.

Even after the massive move, the short interest as a percentage of GameStop’s float remained above 100% at Friday January 22, 2021’s close. S3 Partners is a firm that amongst other things, provides daily short interest data on stocks. During GameStop’s crazy January move, the firm and its data became really popular in the WallStreetSBets community. Every day, the data they released would be used as a method of determining whether shorts had closed out their positions. This is because a large drop in short interest would be a signal that the short squeeze was likely coming to an end.

Below is a graph from December 29, 2020 to January 27, 2021 of the short interest as a percentage of GameStop’s float using data from S3 Partners.

As seen in the graph, even after Friday’s massive move, the ratio remained above 130%, leaving room for the short squeeze to continue as there were a lot of short sellers yet to cover.

Here is how Keith Gill’s investments were doing after this initial move.

His portfolio at this point was now worth more than $10 Million and the WallStreetBets community loved it. The post got more than 93,000 upvotes.

That night, he also ran a 7 hour long livestream on YouTube, where he celebrated his investment returns with a cigar and champagne. He even dipped a chicken tender in his champagne at the 4:23 mark in the video. This was done as an “inside joke” for the WallStreetBets community who often refer to investment returns as “tendies”. The word “tendies” originated from “ten” dollar bills, but due to its similarity with the word “tenders”, the relationship to chicken tenders was drawn.

Below is a screenshot of Keith dipping his chicken tender into his champagne on his livestream.

Event #19

GameStop’s Short Squeeze Continues - Melvin Capital Gets Bailed Out by Citadel and Point72 Asset Management. Link To Article.

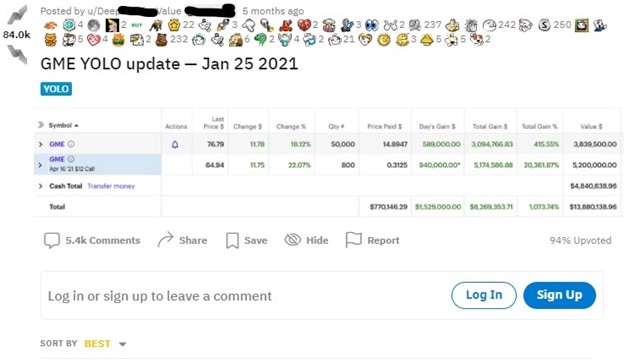

Current Event (Jan. 25, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

What happened?

On Monday, January 25th, 2021 GameStop started the week with the same volatility it had displayed on the prior Friday. The stock opened 48.79% higher than Friday’s close at $96.73. The GameStop story was spreading like wildfire on Reddit which was luring a lot of traders to join in on the exploding stock. The stock soared to $159.18 during the trading day before dropping quickly below the prior Friday’s close, to a low of $61.13. The stock later recovered some it’s previous gains, closing the day at $76.79, again marking an all time high close.

During the trading day, at around 2:49 PM EST, Bloomberg released a story saying that Melvin Capital had received investment funds of $2 Billion from Citadel and $750 Million Point72 Asset Management.

Monday January 25, 2021 would also be the day that the mainstream media news outlets would begin reporting on the reddit driven GameStop rally. Here are some of the headlines from that day.

GameStop stock: The strange but true reason why GME shares keep surging - CNN

GameStop shares are on a wild, Reddit-driven run - The Washington Post

GameStop jumps amid retail frenzy, shares double at one point in wild trading (cnbc.com)

Why was Melvin Capital getting bailed out with new funds important?

The $2.75 Billion that Melvin Capital received as an investment from 2 other hedge funds would be taken as an early sign of defeat by the Reddit community. Due to the rising losses Melvin Capital was experiencing from their GameStop short, it was perceived that the $2.75 Billion in new funds were received as a lifeline in order for them to avoid being forced to close their short position.

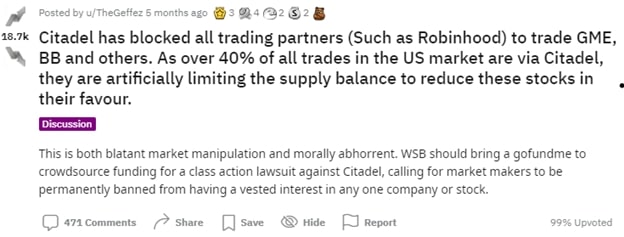

Citadel being the main investor providing Melvin Capital with fresh funds, would become a topic of a lot of controversy in the days following. Citadel LLC is a hedge fund which provides market marking services in the financial markets. They are the largest options market maker in the US and one the largest stock market makers in the US.

A market maker is responsible for making sure that certain stocks and options always have a sufficient amount of liquidity (i.e. there is always someone ready to buy or sell the given stock or option at a reasonable price.). They do this by buying and selling the stocks and options they are the market makers for. In return, Citadel is rewarded by keeping the spread (the difference) between what they buy a given stock or option for from one investor and what they sell the stock or option for to another investor.

Market Makers function by “buying” the orders that traders place through brokerages in order to be able to execute them and make their spreads. This is called Payment For Order Flow. This means some brokerages make a significant amount of their revenue from the sale of their customers' orders to market makers like Citadel LLC. This would be the basis for the controversy that would unfold later that week.

Here is how Keith Gill’s investments were doing after the January 25, 2021 move.

His portfolio at this point was now worth $13.88 Million, $2.7 Million more than what it was worth just 4 days back on Friday, January, 22, 2021. From the post we can tell he is still holding almost all the GameStop investments he was holding the prior Friday. We can see he has only sold 20,000 shares worth of call options and is still holding 80,000 shares worth of call options and 50,000 shares of GameStop.

Event #20

GameStop’s Short Squeeze Continues - Elon Musk Tweets “GameStonk”.

Current Event (Jan. 26, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

What happened?

On Tuesday, January 26th, 2021, GameStop opened the trading session significantly higher than what it had closed at the day before. GameStop opened at $88.56 and eventually rose to a high of $150 before closing at $147.98, marking its third straight trading day of closing at it’s all time high close. The continued rise in GameStop’s stock price gained the mainstream media’s attention and was likely being pushed higher by new non-reddit investors that were joining the party. Right after the close of trading on Tuesday, Elon Musk tweeted “GameStonk!” with a link to the WallStreetBets subreddit, officially solidifying GameStop as a “meme stock”.

Here is Elon Musk’s Tweet.

Here is how Keith Gill’s investments were doing after the January 26, 2021 move.

At the end of the trading day, as he had become accustomed to doing during this time, Keith Gill posted an update of his portfolio. The post was upvoted 136,000 times, an absurdly huge number relative to most Reddit posts.

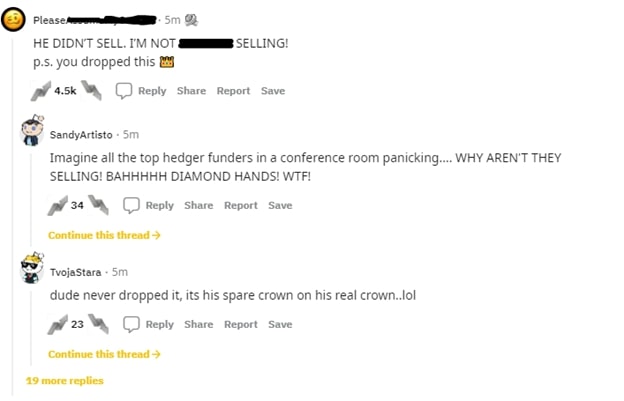

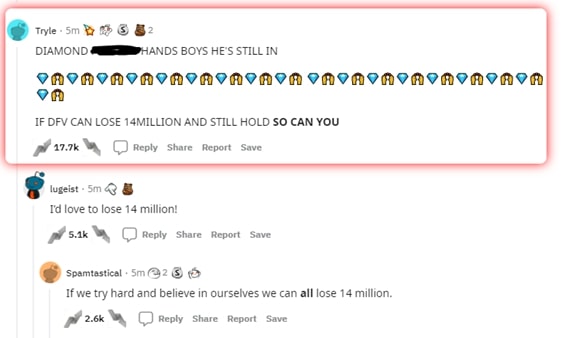

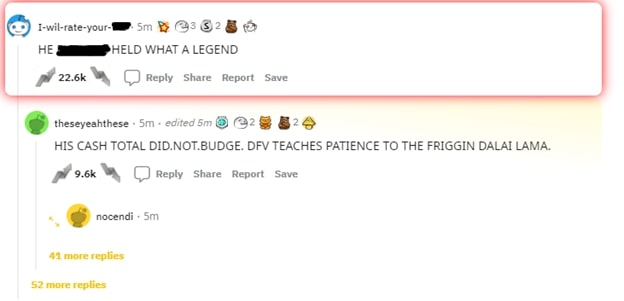

His portfolio at this point was now worth $22.845 Million, $8.965 Million more than what it was worth the day before. The post reveals that Keith held onto all of his GameStop investments from the prior day, even as the stock almost doubled on Tuesday, January 26, 2021. The fact that Keith Gill had more than $17 Million in unrealized gains in GameStop and continued to hold his investments, inspired and fueled some in the WallStreetBets community to continue holding their GameStop investments.

Here is one of the most upvoted comments from the post.

The term 'Diamond Hands' used by the redditor in the comments above, is used on WallStreetBets to describe a person who is able to hold onto their investments through the most difficult times.The term references the strength of diamonds and applies it to an investor’s hands, as if to say “hands so strong, no one can take their investments from them”.

GameStop’s meteoric rise would continue the following day.

Event #21

GameStop’s Short Squeeze Continues - Melvin Capital and Citron’s Andrew Left Claim to Have Closed Their Short Positions.

Current Event (Jan. 27, 2021)

Prevous Events

Final Event (Jan. 28, 2021)

What happened?

On Wednesday, January 27th, 2021, in the pre-market trading session, GameStop traded more than 100% higher than the previous day’s close. Eventually the stock opened at $354.83, 140% higher than it’s closing price on Tuesday, January 26th, 2021. The new mainstream media coverage GameStop’s stock was receiving as well as the attention it was getting from celebrities and entrepreneurs like Elon Musk, had gained the stock a new wave of mainstream investors. This likely helped spur the significant rise in price GME experienced. The morning started with CNBC announcing at around 6:21 AM EST that Melvin Capital had finally capitulated and had closed its short position the day before. 20 minutes later, at 6:47 AM EST, Andrew Left of Citron research, released a video on Twitter claiming he had also closed most of his short position and had only left a small marginal short position open. Here is his tweet.

During the trading day, the stock fluctuated between a high of $380 and a low of $249 before closing yet at another all-time high close of $347.51.

Why was CNBC claiming Melvin Capital had closed its short position important?

CNBC’s release, as well as other news releases claiming Melvin Capital had closed their short position were highly disputed in the WallStreetBets community. Many Redditors believed these releases were a tactic being employed by Melvin Capital to convince them that they had closed their short position, and thus the end of the short squeeze was imminent. The Redditor’s believed the goal was to cause investors to sell GameStop shares, allowing Melvin Capital to close their short position at a lower price, and suffer less losses.

Various posts were made on the topic in the WallStreetBets subreddit, here is the most upvoted one.

Whether or not Melvin Capital had closed their short position, the short interest reported by S3 Partners at the end of trading on January 27th, 2021 showed that the short interest was still at 139.73% of the float. This meant that either new shorts had taken Melvin Capital’s place, or Melvin Capital had not closed their short position, either way the potential for GameStop’s shares to continue rising was still there. Here is the tweet from Ihor Dusaniwsky from S3 Partners.

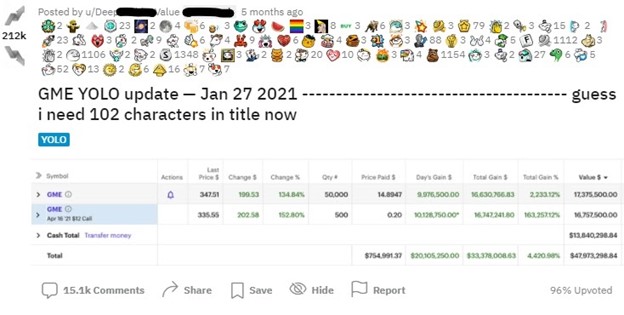

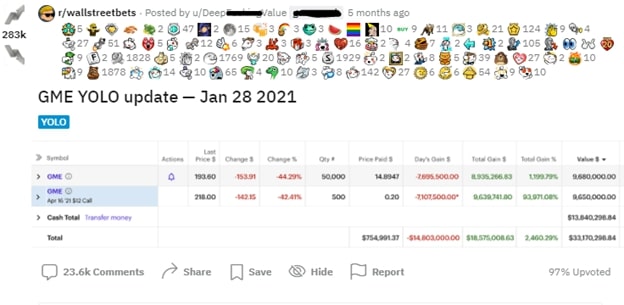

Here is how Keith Gill’s investments were doing after the January 27, 2021 move.

At the end of the trading day, Keith Gill posted his usual update of his portfolio. This post was upvoted an extraordinary 212,000 times.

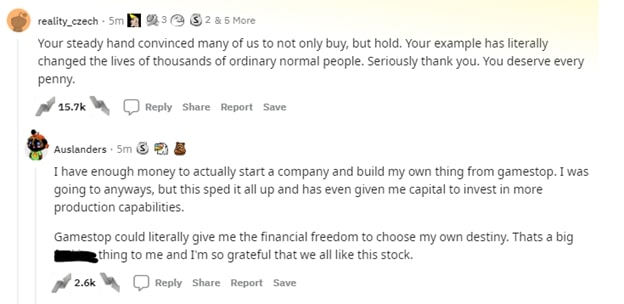

His portfolio had more than doubled from the day before and was worth an astonishing $47.973 Million at this point, $25.127 Million more than what it was worth the day before. This is the largest portfolio value he ever posted on his reddit update posts. The post reveals that Keith held onto most of his GameStop investments from the prior day, even as the stock more than doubled from the day before. We can see that he sold 30,000 shares worth of call options and continued to hold all 50,000 shares he had from the day prior. Just like his previous update posts, seeing Keith continue to hold his GameStop investments, continued to inspire some from the Reddit community to keep holding theirs. Here are some of the most upvoted comments on his update post.

Event #22

GameStop reaches its all time high of $483. Robinhood and other brokerages prohibit the buying of GameStop.

Current Event (Jan. 28, 2021)

Prevous Events

What happened?

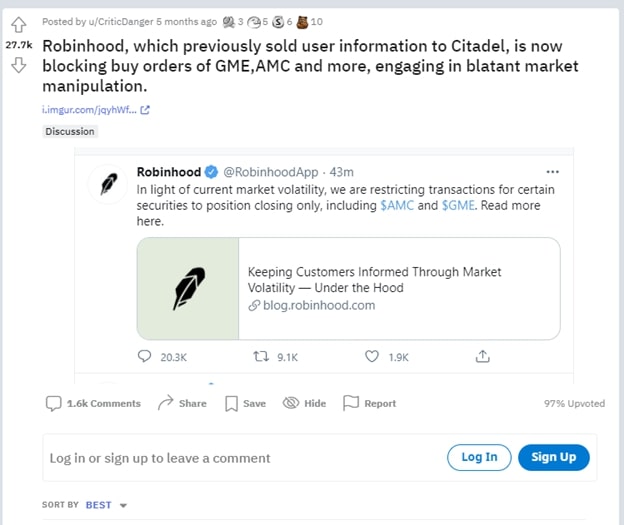

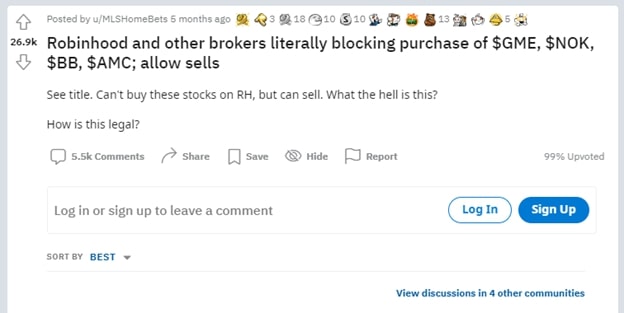

On Thursday January 28, 2021 GameStop’s stock started right where it had left off the previous day. The stock traded significantly higher early in the pre-market trading session, briefly trading as high as $500. However, prior to the open of the trading day, news that Robinhood and Interactive Brokers were restricting the purchase of GameStop shares and GameStop options, caused the stock to drop and it would end up opening the day at $265, 23.74% lower than what it closed at on the previous day.

Early in the trading day, the stock recovered and traded as high as $483, which to this day is GameStop’s all time high. Shortly after, as traders realized that most popular brokerages were only allowing its users to sell GameStop shares or close out option positions, the stock dropped rapidly from its peak at $483 to a low of $112.25 before closing at $193.60, 44.29% lower than the previous day’s close.

See Trading Near Their 10 Year Highs Today

See NowThe trade restrictions being placed by popular brokerages, specifically by Robinhood, would trigger a bout of controversy on WallStreetBets and would lead to a significant spike of negative reviews about RobinHood on App stores. This day would mark the peak of GameStop’s stock price as of the release date of this article, October 20th, 2021.

Here’s what the price action looked like on Thursday, January 28, 2021.

Why did Robinhood and other brokerages restrict trading on GameStop shares and GameStop options?

The reasons that led to Robinhood and other brokerages limiting trades in GameStop are complicated and this article by BloombergQuint does a great job at explaining them simply. It has to do with the inner workings of how the market actually functions.

When traders make a trade through their brokerage, the shares or options aren’t actually exchanged between the brokerage of the buyer and the brokerage of the seller until the settlement date. The settlement date is 2 business days after the trade was made (T+2) for stocks and 1 business day after the trade was made (T+1) for options. The trades are settled by financial services firms called clearing houses. To reduce the risk that brokerages involved in a trade will default or be unable to comply with their portion of the trade on settlement day, clearing houses ask the brokerages to send the clearing houses cash or bonds as collateral.

The collateral is normally some percentage of the value of the trade, and that percentage increases or decreases depending on how much risk a clearinghouse perceives there might be that one of the brokerages might not be able to settle the trade. In GameStop’s case, brokerages were allowing traders to buy GameStop shares “on margin” or using loaned money from the brokerages, this is a normal practice for brokerages. The unique risk to GameStop was how violently the price was fluctuating.